Executive Summary

Brand congruence transforms how organizations deliver on their promises. At RevEng, we have developed a structured approach that moves from diagnostic clarity through arena-specific program design to sustainable implementation. This article explains how we help clients identify congruence gaps, prioritize high-impact opportunities, and build the organizational discipline required for lasting alignment.

Most companies notice when something isn't working. Sales cycles lengthen, win rates decline, customer acquisition costs rise, and churn increases despite product improvements. These issues often stem from a shared root cause: a misalignment between the organization's promises and the actual customer experience.

The challenge is that congruence gaps can exist anywhere in the system. Marketing might set expectations that Product cannot meet. Product might deliver capabilities that Service cannot support. Service might make promises that Channel partners do not honor. Without a structured approach to diagnosis and remediation, organizations chase symptoms while the underlying misalignment persists.

RevEng's approach addresses this challenge through three integrated phases: diagnostic clarity, arena-specific program design, and implementation with governance. Each phase builds on the previous one, creating momentum toward sustainable alignment.

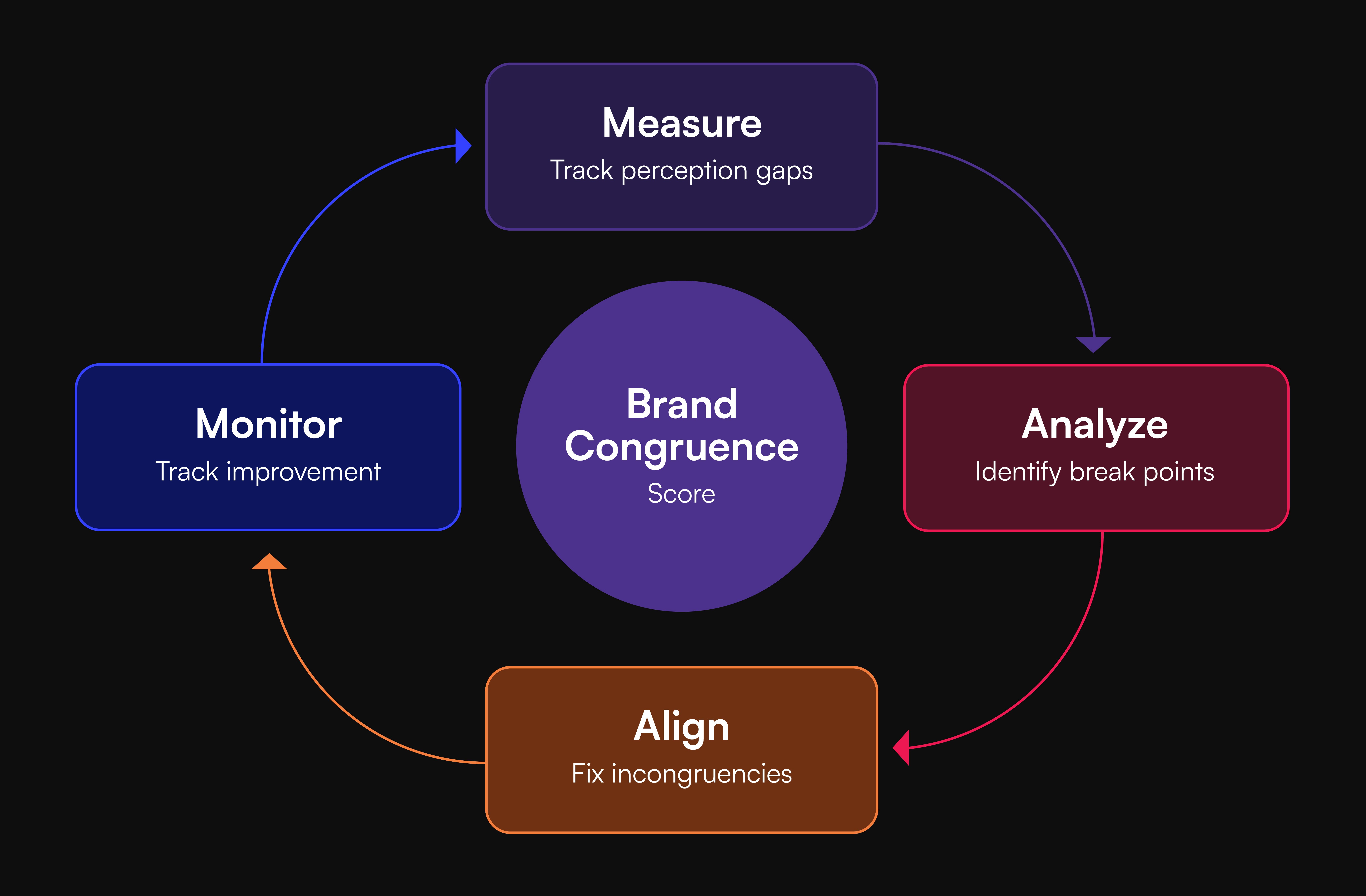

The visual below illustrates this approach:

Diagnostic Clarity

Arena-Specific Program Design

Implementation with Governance

The first phase establishes a clear, evidence-based picture of current state alignment. This is not a satisfaction survey or a brand health study. It is a systematic examination of where Say, Do, and Experience align or diverge across all four arenas. The visual below shows the four key outputs produced in this phase.

12-Box Assessment

We begin with the 12-box matrix, scoring each intersection of arena (Marketing, Product, Service, Channel) and dimension (Say, Do, Experience). Scoring considers two factors: Severity measures the gap between promise and delivery. Impact measures the extent to which this gap affects revenue, costs, or trust.

This assessment combines quantitative and qualitative inputs. Quantitative measures include feature usage rates, performance versus claims, return and complaint rates, NPS and CSAT by feature, first-contact resolution rates, channel mystery-shop scores, and conversion rates by touchpoint. These numbers reveal where delivery falls short of promise.

Qualitative insights include customer interviews to explore promise comprehension and payoff, journey mapping to identify perception-shift moments, social listening for real customer stories, and observation studies of real-world use. These insights reveal why gaps exist and how customers interpret them.

The goal is not to achieve perfect scores. It is to identify where gaps create the greatest drag on growth and trust. A small gap in a high-impact area matters more than a large gap that customers rarely encounter.

Journey Mapping

Beyond the 12-box assessment, we map the journeys that matter most to your business. Modern customer journeys are nonlinear, with customers researching, validating, and reconsidering multiple times. At each stage, they gather evidence: do reviews support your claims? Do demonstrations align with advertisements? Does post-purchase support reinforce their decision?

Journey mapping identifies the moments that matter most—where congruence can compound trust or where gaps can erode it. These "signature moments" become focal points for improvement. A signature moment might be the first five minutes of product use, the first service interaction, or the in-store demonstration. These moments disproportionately shape overall perception

Segment-Specific Analysis

Different segments value different things. Enterprise customers need proof of scalability and security; mid-market customers want implementation speed and support responsiveness; and small-business buyers may prioritize simplicity and value.

Effective congruence is segment-aware. We analyze alignment for your priority segments, identifying where segment-specific experiences are strong and where they need attention. The framework adapts what you emphasize by segment while staying authentic and consistently being yourself in ways that matter most to each audience.

Diagnostic Outputs

Phase one produces several key deliverables: a 12 Box Scorecard with current-state scores by arena and dimension; a Gap Analysis that prioritizes opportunities by potential impact; Journey Maps documenting signature moments for priority segments; and a Segment Alignment Assessment that captures where segment-specific delivery needs require work.

These outputs create the evidence base for program design and investment prioritization. They also create alignment among stakeholders. When everyone sees the same data, debates shift from opinion to evidence.

When everyone sees the same data, debates shift from opinion to evidence.

With diagnostic clarity established, the second phase designs targeted programs for each arena where gaps exist. Not every organization needs work in all four arenas. The diagnostic identifies where to focus. The visual below shows the types of programs we design for each arena.

Marketing Arena Programs

When marketing gaps exist, we design programs addressing:

Promise Audit and Alignment

Reviewing every claim for believability and deliverability

Touchpoint Mapping

Documenting where the promise appears and checking consistency

Experience Alignment

Updating assets, training teams, locking in guidelines

Measurement Feedback

Instrumenting perception tracking and creating rapid response protocols

Product Arena Programs

When marketing gaps exist, we design programs addressing:

Feature Promise Alignment

Mapping claims to capabilities

Experience Design

Focusing on first impressions, everyday use, and problem moments

Digital-Physical Integration

Ensuring connected products work as unified systems

Segment Tuning

Adapting product experience by segment while maintaining brand consistency

Service Arena Programs

When service gaps exist, we design programs addressing:

Promise Calibration

Reviewing commitments against operational capacity

Delivery Optimization

Improving access, response, resolution, and follow-through

Experience Design

Addressing effort, fairness, and trust

Partner Service Integration

Extending standards to dealers, retailers, and franchisees with aligned compensation

Channel Arena Programs

When channel gaps exist, we design programs addressing:

Standards Definition

Establishing non-negotiables for brand presentation

Enablement Systems

Creating learning paths, battlecards, and guided selling tools

Controls and Governance

Implementing certifications, audits, and tiering

Economic Alignment

Ensuring incentives reward brand-right behaviors

The critical insight for channel programs:

You cannot train your way out of bad incentives. If partner economics reward behaviors that contradict your brand promise, partners will follow their economics regardless of training quality.

Designed programs only create value when implemented effectively. The third phase focuses on execution at scale and the governance systems that sustain alignment over time.

Implementation Readiness

Before launch, we ensure content and tools are finalized, including updated assets, scripts, training materials, and partner toolkits. Training is completed through train-the-trainer sessions for internal teams and certifications for partners. Systems are configured with dashboards, measurement instruments, and alert systems. Communications are prepared, covering change management messaging for internal teams, partners, and customers.

Launch and Support for Major Congruence Initiatives

Major congruence initiatives are launched with dedicated support, with daily check-ins during the initial phase to address emerging issues, validate data, and make swift adjustments. Following this period, weekly reviews help monitor progress, address exceptions, and share early successes. This approach fosters momentum and identifies potential problems early, helping to prevent them from becoming ingrained.

The Congruence Scorecard

Sustainable alignment requires ongoing measurement. We track five dimensions that together reveal whether congruence is strengthening or eroding. The visual below shows these dimensions and their key metrics.

Promise Integrity

Expectation Setting

Vs. Reality

Claim Accuracy

Delivery Match

Experience Health

Task Success

Effort Required

Time to Value

Friction Points

Trust & Advocacy

NPS

Reviews

Referrals

Complaints

Economics

Conversion

Retention

CAC

LTV

Channel Fidelity

Partner Adherence

Mystery Shop Scores

Brand Presence

Sustainable alignment requires ongoing measurement across all 5 dimensions

Operating Rhythm

The operating rhythm maintains focus on alignment throughout the monthly cycle. Early in the cycle, the team gathers voice-of-customer insights, reviews operational KPIs, and assesses competitive intelligence. Mid-cycle, data analysis is conducted, scores are updated, and new gaps are identified. Later, intervention priorities are set, owners are assigned, and deadlines are established. The cycle concludes with communication of wins, challenges, and decisions to stakeholders.

This rhythm ensures that alignment is an ongoing effort rather than a one-time initiative that diminishes over time. It helps develop organizational capacity for continuous synchronization. The visual below shows how the feedback loop operates.

Week 1: Gather

VOC

Reviews

KPI's

Week 2: Analyze

Update Scores

Isolate Deltas

Week 3: Plan

Prioritize

Assign Owners

Week 4: Communicate

Wins

Challenges

Decisions

Governance Structure

Lasting congruence depends on clear decision rights. We assist in creating a Brand Congruence Council with representatives from Marketing, Product, Service, Channel, and Digital. This council has defined decision-making frameworks—who recommends, decides, and executes—and funding authority to allocate resources efficiently and without delay. Additionally, leadership incentives are aligned with congruence outcomes.

Every organization's congruence journey is different. Some face urgent moments of truth: a product launch, a market entry, a competitive response. Others are building long-term commercial excellence and want to systematically strengthen alignment over time.

Regardless of the starting point, the first step is diagnostic clarity. Understanding where alignment is strong, where gaps exist, and which gaps have the greatest impact on growth and trust.

We invite you to start with the 10 Minute Assessment from our anchor article, then reach out to discuss what a diagnostic engagement might reveal for your organization.

Brand congruence is not a one-time project. It is an ongoing discipline that compounds value over time. The organizations that invest in systematic alignment today build advantages that competitors struggle to replicate.

This article is part of the Brand Congruence series. To discuss how RevEng can help your organization build brand congruence, Contact Us.